Growth of Non-Banking Financial Sector in India: Trend and Determinants

September 2023 | Arvind Awasthi and Siddharth Shukla

I Introduction

Non-Banking Financial Companies (NBFCs) are an integral part of Indian financial system. They are lender of first resort for the large group of niche segments which remains underserved by the mainstream banking sector such as financing of second-hand vehicles, construction equipment, working capital financing, customized loans to micro and small industries, etc. Moreover, they also provide basic financial services such as micro-insurance, loans, savings instruments etc. to the poor and marginalized sections which do not have access to mainstream banking (Bhaskar 2014). Therefore, it won’t be wrong to say that the NBFCs are the bank of the poor. Apart from this, NBFCs also broaden the capital base of the economy by providing finance to the infrastructure projects and invest heavily in the real estate segment through Infrastructure Finance Company (NBFC-IFC), Infrastructure Debt Fund (NBFC-IDF) and Housing Finance Company (HFC). Importance of the NBFC sector is also evident by its increasing share in the Indian economy which is reflected in the robust increase in the share of its asset size to the gross domestic product (GDP) at current price from 7.94 per cent in 2005-2006 to 16.6 per cent in 2019-2020.

Healthy and robust growth of the NBFC sector is thus a definite indicator of the growth of small and marginalized segments of economy. Hence, it is extremely important to analyze the trend of growth of the NBFC sector. The total number of non-banking financial companies has fallen from 13,014 in 2005-2006 to 9618 in 2019-1920 (refer Appendix Table A1). In contrast to it, asset size of the non- banking financial company sector has increased multifold during the same period (refer Appendix Table A2). In terms of asset size, with compound annual growth rate of 18.7 per cent per annum during 2005-2006 to 2019-2020, NBFCs are one of the fastest growing segments of the Indian financial system. Surge in the growth of assets may be on account of several factors which may involve some sector- specific and few macro-variables. With regard to sector specific factors, one of the most important factors is the source of funds for the non-banking financial company’s sector. Funds are mobilized from two sources namely banks borrowings and market borrowings. However, due to Infrastructure Leasing and Financial Services (IL&FS) crisis and its impact on the investor’s confidence, the share of market borrowings shrank and dependence on bank borrowings increased (Report on trend and progress of banking in India, 2019-2020) which is evident from the decline in the ratio of market borrowings to bank borrowings from 3.1 in 2016-2017 to 1.9 in 2019-2020. Further, the investment rate of the economy, ratio of gross fixed capital formation to gross domestic product, is a major macro- economic variable that can affect the NBFC sector. It has fallen from 32.7 per cent in 2005-2006 to 28.7 per cent in 2019-2020. Apart from these factors, the most important factor which contributed to the growth of NBFCs in India is the fact that they are lightly regulated vis-à-vis banks and imposition of lighter regulations provided them space to breathe freely and expand at a faster pace.

Above growth story of non-banking financial companies is accompanied with the consistent tightening of regulatory norms on the sector. Reserve Bank of India introduced a revised regulatory framework in 2014 in which the threshold of asset size for identifying the non-deposit taking systemically important non-banking financial companies is revised from ₹100 crore to ₹500 crore. Moreover, the threshold of minimum net owned (NOF) increased from ₹2.5 million to ₹20 million and the capital adequacy framework was further strengthened by raising the requirement of Tier I capital for NBFC-ND-SI and NBFC-D up to 10 per cent in a phased manner by March 2017. Moreover, asset classification and income recognition norms were also subsequently introduced. Despite shielding the non- banking financial companies with a number of regulations, the sector was hit by a major crisis in 2018 when a large core investment company (NBFC-CIC) named Infrastructure Leasing and Financial Services (IL&FS) defaulted on several of its debt obligations and triggered a liquidity crisis in the NBFC sector which in turn affected the flow of funds in this sector. This shook the confidence of investors who are actively investing in the sector and hence in order to restore the confidence, RBI took a slew of regulatory and supervisory measures which are now tightening the loosened hold on this sector. Some of the important policy responses were amendments in the RBI Act 1934 through Finance Bill 2019 which conferred powers on RBI to supersede the board, remove the directors of NBFC and several other governance measures, liquidity risk management framework for NBFCs in 2019 and scale-based regulatory framework for NBFCs in 2021. All the aforementioned measures were taken with the objective of protecting the NBFC sector from any major collapse which could amplify and may transform in a systemic risk contagious to other segments of the financial system due to high interconnectedness and hence pushing the financial system in a state of paralysis. Undoubtedly the objective behind these measures is a noble one, but it also carries the potential to slow down and negatively affect the growth of NBFC sector. The statement is not without logic as the prudential norms introduced by RBI in the recent past is imposed on two important sub-sections of the NBFC sector namely deposit taking NBFCs (NBFC-D) and non-deposit taking systemically important NBFC (NBFC-ND-SI). Among the two, NBFC-ND-SI holds 85.7 per cent of total assets of the NBFC sector. Imposition of regulations on this segment implies covering almost 86 per cent of NBFCs asset under relatively strict regulations. Instead of extending the regulations to such a large segment, it is important to place prudential regulations on few handful of companies which are identified to be posing a threat to the financial system. In global space such financial institutions are tagged as systemically important financial institutions (SIFI).

Globally, the tag of systemically important is assigned only to those financial institutions that have crossed thresholds of defined qualitative and quantitative parameters and are posing a threat to the financial system in such a manner that may cause systemic failure due to their collapse. In India, on the other hand, the term systemically important is used to denote the non-deposit taking NBFCs that have crossed the asset size limit of ₹500 crores, the threshold of which has now been revised to ₹1000 crore in recently published scale-based regulations for NBFCs, with the underlying assumption that they all pose systemic threat to the financial system and hence they do not undergo any filtration process. This classification of the systemically important is not only in wide divergence with the spirit in which it is used across the globe but is also the cause of encompassing the entire NBFC sector within the ambit of newly introduced regulations on the NBFC sector. Therefore, in the light of increasing relevance of the NBFC sector in Indian economy and impact of regulations on its rate of expansion, it is important to study the trends of various growth indicators of the NBFC sector and impact of some sector specific and macro-economic indicators on its rate of expansion.

II Literature Review

The purpose of this article is to analyse the growth of non-banking financial companies in India and investigate the impact of several factors affecting the growth of assets of non-banking financial companies. In this context, Ordonez (2018) has highlighted that the regulation such as capital requirements on banks are both blessings and a curse as it, on the one hand, compels banks to avoid investment in risky asset but it also prevents investment in highly efficient assets that are mis-classified as risky. Shadow banking covers the avenues which provide banks with an option of superior investment opportunity along with highly risky investment option. He further found that presence of shadow banking in an economy optimizes the allocation of funds. Moreover, shadow banking expands on account of asset bubbles and higher leverage. He also concluded that tightening of regulation on shadow banking in United States of America through Basel III accord and Dodd-Frank Act, is not healthy for the growth of shadow banking because in spite of the fact that it reduces risks, simultaneously it also quashes the possibility that banks could invest in more efficient financial product. Although facilitating shadow banking activities pose high risk of crises, it also equips economy with larger investment efficiency. Therefore, he proposed that banks should be allowed to decide whether they want to be regulated or unregulated. If they choose to be regulated then, they should be subsidised and those that chose to avoid regulations should be taxed. Therefore, banks with superior assets would choose to avoid regulation and prefer to invest in risky assets but banks with inferior asset would prefer to be regulated. They will optimize both the risks and investment efficiency. He also showed that although regulators face trade-off between discouraging excessive risk-taking and preventing efficient investment, optimization lies in not discouraging the shadow banking.

Apostoaie and Bilan (2019) have assessed the determinants of growth of shadow banking in 11 Central and Eastern European countries for the period 2004- 2017 using the panel data estimation technique. For independent variable, they have considered real gross domestic product growth rate, growth rate of total financial assets of insurance corporation and pension funds, term spread, money market rate, growth of assets of monetary and financial institutions and growth rate of total reserves except gold. Growth rate of total financial assets of other financial institutions (excluding pension funds and insurance companies) and growth rate of total financial assets of other financial institutions (excluding pension funds and insurance companies and investment funds) are the dependent variables. They found that economic growth has a positive impact on the expansion of shadow banking sector. Further, funds demanded by the institutional investors also have a positive impact on the expansion of shadow banking sector. During the low interest rate period, investors head towards shadow banks in search for better yields, leading to a positive impact on growth of shadow banks. Lastly, shadow banks grow in pro-cyclical manner with the development of the rest of the financial system, especially banks.

Green and Broomfield (2013) have criticized the old view of policy debate and regulatory framework on shadow banking. They have considered origin of non-bank entities as a consequence of regulation on regular shadow banking system. They also cynically discussed the application of prudential bank regulation on NBFCs and efforts to limit the exposure of commercial banks from entities and activities outside the regular banking system. According to them, in the present complex financial system, banks and non-banks cannot be examined in isolation. They further appreciate the Financial Stability Board’s move to address the shadow banks on the basis of economic function rather than as entities. Regulation should be imposed by examining the activities rather than simply on the basis of entities. It will be far flexible and won’t be blocking the growth of non-banks. Similarly, Financial Stability Oversight Council made the move to designate systemic activity and address the issues of regulation on them rather than simply identifying the non-bank systemically important financial institutions and extending banking laws to them, because banking regulation have matured overtime, to tackle the function of a special kind of financial institutions. And their extension to non-banks is dubious. Moreover, since the origin of non-bank was caused by excess regulation on commercial banks, therefore, simply extending the banking regulation to non-banks will again shift the risk beyond the scope of regulation. There is a need to adopt a tailored regulatory framework that will contain the risk without nudging it to shift beyond regulatory framework. Lastly, they have concluded that non-banking activities are an entrenched component of financial system and there is a need to adopt policies that retain the benefits of shadow banks and maintaining the diversity and resilience of the financial system. In a report named Strengthening the Regulation and Oversight of Shadow Banks, prepared by Gelzinis (2019), it is emphasized that the lack of regulation and supervision on large and deeply interconnected shadow banks was one of the chief factors behind the Global Financial Crisis of 2007-2008. Failure of large systemically important non-bank financial companies such as AIG and Lehman Brothers, heavily damaged the financial system of United States of America. Absence of a centralised regulatory and supervisory body which could look across the financial system led to creation of various arbitrages which were used by financial institutions to establish their operations in line with these arbitrages. All these factors led to the passing of Dodd-Frank Act which established Financial Stability Oversight Council (FSOC) with the power of identifying the systemic risk and mitigating it. And one such power was designating systemically important non-bank financial companies and imposition of enhanced prudential norms on them. However, during the Trump administration, the FSOC was significantly diluted by reducing its budget, cutting down of staffs and introduced major amendments in the designation procedure. These steps made the financial system of USA more exposed to threats. The Report recommended four policy proposals to strengthen the regulatory framework shadow banks which will further make the financial system more resilient and robust.

Oncu (2013) has explained the definition of shadow banking in detail. The term shadow banking was coined by economist Paul McCulley and the most popular definition is given by the Financial Stability Board (FSB) which is explained as the credit intermediation involving entities and activities outside the regular banking system. In Indian context, Reserve Bank of India considers non- banking financial company as analogous to shadow banking system because they perform the credit intermediation activities outside the ambit of regular banking system of India. Reserve Bank of India has classified non-banking financial companies on the basis of functions they perform, their systemic importance and the acceptance of deposits. The author has broadly classified the non-banking financial companies into investment and finance companies. Among the non- deposit taking systemically important non-banking financial companies, finance companies form almost 70 per cent of total assets of all systemically important ones in 2011 and are actively performing the credit intermediation function along with relatively higher interconnectedness with the banks.

Acharya, et. al. (2013) have analysed the growth of non-banking financial companies (NBFCs) in India and found that NBFCs in India are a substitute of banks in non-urban regions for direct lending. They have considered the dataset of non-deposit taking systemically important non-banking financial companies (NBFC-ND-SI) constituting two major sets namely investment and financing companies for the period 2006-2011. Since NBFCs depend significantly on the funds given by banks as source of their funding, they studied the impact of NBFC- Bank linkage on the credit growth along with variation in linkage across different types of banks, i.e., public sector as well as private sector banks, rural versus urban bank and between investment and financing type of NBFCs. Further, they also studied the impact of global financial crisis 2008 on these linkages. They have found that bank’s lending to NBFCs varies with bank’s allocation to priority sector lending and is inversely related with the expansion of bank’s branches in the non- urban region. Moreover, this NBFC-bank linkage exists and affects only the credit growth of loan financing NBFCs and not of investment companies. Therefore, they reached the conclusion that the NBFCs are viewed as substitute of bank’s lending in non-urban parts of India. After the global financial crisis 2008, bank’s lending to NBFCs contracted due to shift of term deposits.

Research Gap: Due to lack of enough detailed study on growth of non-banking financial companies in India, it has become mandatory to undertake detailed exercise regarding the growth of their asset size and factors which have impacted their growth over the years 2005-2006 to 2019-2020. It is also important to have detailed analysis because of increasing regulations through recently introduced scale-based regulations which will bring massive fundamental change in the structure of NBFCs and consequently will affect the growth of the non-banking financial company sector.

III Objectives and Hypotheses

In view of the fact highlighted in the research gap that there is hardly any detailed study regarding growth of non-banking financial companies and factors that have impacted the growth over the years 2005-2006 to 2019-2020, we have formulated two objectives:

- To analyze the pattern of growth of non-banking financial companies in terms of their numbers and asset size.

- To analyze the factors affecting the asset size of non-banking financial companies.

Given the introductory background, we have observed that there has been a decline in the number of non-banking financial companies over the period under study (2005-2006 to 2019-2020) which doesn’t augur well for expansion of their volume of business growth in the country. As regards the association between the number of non-banking financial companies and their asset size, we have hypothesized that:

Ha0: There exists no relationship between number of non-banking financial companies and their asset size.

Ha1: There is a significant negative relationship between number of non-banking financial companies and their asset size.

In addition, it is also been observed in the introductory background that policy intervention by Reserve Bank of India, specially since 2014, has gained pace which could prove detrimental in the efforts put up by non-banking financial companies to expand their activities. Hence, in order to trace the impact of policy changes on the growth of asset size, our hypothesis is as follows:

Hb0: There exists no significant negative impact of policy interventions by Reserve Bank of India on asset size of non-banking financial companies.

Hb1: There is a significant negative relationship between policy interventions by Reserve Bank of India and asset size of non-banking financial companies.

Further, one expects cyclical movement of growth of asset size of non-banking financial companies with ratio of market borrowings to bank borrowings as well as with the investment rate in the economy. In this context, we have hypothesized that:

Hc0: There exists no relationship between ratio of market borrowings to bank borrowings and asset size of non-banking financial companies as well as between investment rate and asset size of non-banking financial companies.

Hc1: There is a significant positive relationship between ratio of market borrowings to bank borrowings and asset size of non-banking financial companies as well as between investment rate and asset size of non-banking financial companies.

IV Methodology and Data Source

The number of non-banking finance companies and their asset size are plotted for the period 2005-2006 to 2019-2020. Growth rate of number of non-banking finance companies and their asset size is calculated using the Compound Annual

Growth Rate (CAGR). The generalized compound annual growth rate is obtained through following equation:

Yt = abt

where Y is the variable for which compound annual growth rate is to be estimated, a is constant, b is regression coefficient, t is time period and compound annual growth rate is estimated using following formula:

CAGR = (Exp(b)-1) *100

We have also estimated the linear growth rate of a number of non-banking financial companies for the periods 2005-2006 to 2016-2017 and 2016-2017 to 2019-2020 by estimating β in the equation:

Nt = α + βt

Where N is the number of non-banking financial companies, α is the constant, β is the regression coefficient and t is time. Once β is estimated, linear average growth rate for each time period is computed by dividing β with the mean of N. Further, weighted linear average growth rate which is the horizontal weighted summation of two linear average growth rates from 2005-2006 to 2016-2017 and 2016-2017 to 2019-2020 is estimated as follows:

Nt = (w1N1 + w2N2)/ (w1 + w2)

Where Nt is weighted linear average growth rate at time t, w1 is weight assigned to the linear average growth rate for the period 2005-2006 to 2016-2017 (N1) and w2 is weight assigned to the linear average growth rate for the period 2016-2017 to 2019-2020 (N2). These weights are on the basis of number of years covered in each of the two periods.

In order to capture the impact of policy intervention of Reserve Bank of India in the non-banking financial companies (NBFCs) sector which gained pace since 2014 and were further strengthened post Infrastructure Leasing and Financial Service (IL&FS) crisis, along with the impact of a number of non-banking financial companies, we have applied the dummy variable regression model as it is a regression model with the admixture of both qualitative and quantitative parameters. We have considered the log values of a number of non-banking financial companies and a dummy variable as explanatory variable assigning values 1 since 2017-2018 and 0 otherwise. We have analyzed their impact on the dependent variable which is the log values of the asset size of non-banking financial companies. The regression equation, therefore, is:

Ln (At) = α1 + β1(Ln Nt) + β2(Di) + ut

Where At is the asset size of non-banking financial companies at time t, α1 is the intercept term, β1 is regression coefficient associated with the number of non- banking financial companies at time t (Nt) and β2 is the regression coefficient associated with dummy variable (Di), such that Di = 1 for the period 2017-2018 to 2019-20 and 0 otherwise for the period 2005-2006 to 2016-2017, ut is the error term.

Further, we have performed a multiple regression analyses to analyze the determinants of growth of NBFCs assets with NBFC asset as dependent variable and a number of NBFCs, dummy variable, ratio of market borrowings to bank borrowings and investment rate in the economy as four explanatory variables. The multiple regression model is shown as follows:

Ln (At) = α + β1Ln(Nt) + β2(Di) + β3Ln(MB_BB) + β4Ln(gfcf_gdp) + ut

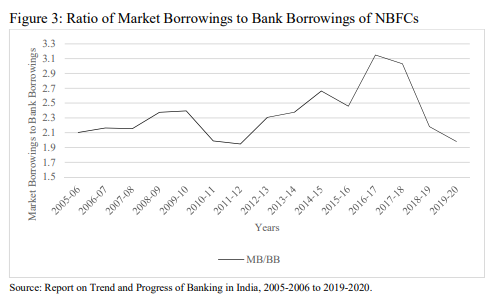

Where At is asset size of non-banking financial companies at time t, α is the intercept term, β1 is regression coefficient associated with the number of non- banking financial companies at time t (Nt), β2 is regression coefficient associated with dummy variable (Dt), such that Dt = 1 for the period 2017-2018 to 2019-2020 and 0 otherwise for the period 2005-2006 to 2016-2017, β3 is regression coefficient associated with ratio of market borrowings to bank borrowings of non-banking financial companies (MB_BB) and β4 is the regression coefficient associated with ratio of gross fixed capital formation to gross domestic product at current price (gfcf_gdp) and ut is the error term. We have also plotted the ratio of market borrowings to bank borrowings of the non-banking financial companies’ sector for the period 2005-2006 to 2019-2020.

Data of numbers of non-banking financial companies, their asset size and ratio of market borrowings to bank borrowings is accumulated from various editions of report of trend and progress of banking in India for the period 2005- 2006 to 2019-2020. Data of gross fixed capital formation and gross domestic product at current prices is obtained from the website of ministry of statistics and programme implementation (MoSPI). We have taken up the period after 2005- 2006 because of the introduction of a new category of non-banking financial company namely systemically important non-deposit taking non-banking financial companies (NBFC-ND-SI) which have a major share in total assets of the NBFC sector.

V Analysis

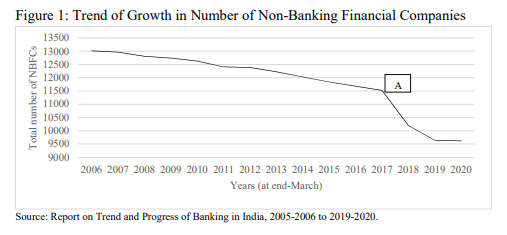

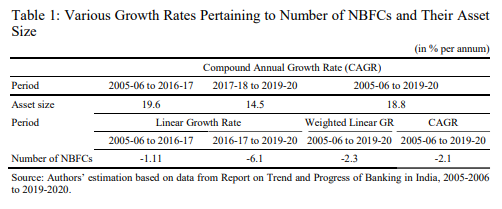

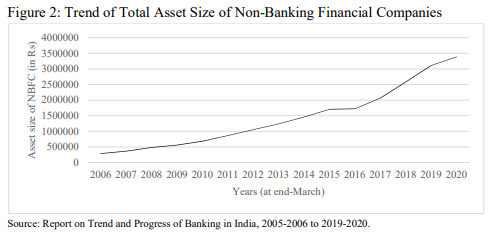

Keeping in view the first objective, we have analyzed the growth of non-banking financial companies in terms of their number and asset size for the period 2005- 2006 to 2019-2020. In 2005-2006, the total number of NBFCs was 13,014 which declined to 9,618 in 2019-2020. However, asset size of NBFC sector has increased from ₹2,88,593 crores to ₹33,89,267 crores in the said period. A macro look at trend of total number of NBFC shows that the decline has been steady up till 2016- 17 and then the reduction has become more steep after 2016-2017 (refer Figure 1).

The decline in the number of NBFCs has been at a rate of 2.1 per cent, since 2005-2006 to 2019-2020 (refer Table 1). However, a closer scrutiny of this broad trend (refer figure 1) shows a point of kink at A corresponding to year 2016-2017, post which there is a steep fall in number of non-banking financial companies. This could be regarded as an important point of change in the pattern of decline in the number of non-banking financial companies. It has in fact split the overall trend into two different linear paths with latter being far steeper than the former. Therefore, year 2016-2017 could be regarded as the year of great divide in the one and half decadal history of number of NBFCs. Considering 2016-2017 as the year of great divide, the weighted average growth rate of the two linear paths (one prior to A and other after it) is in excess of CAGR for the entire period (refer Table 1). This reflects the steeper tendency of decline in NBFCs than what otherwise one could have inferred just on the basis of CAGR of the number of NBFCs. This is a matter of concern and requires investigation to know the rationale behind this pattern of decline in the number of NBFC.

The continuous decline in the number of non-banking financial companies was on account of greater cancellation of certificate of registration as compared with the new registrations. The increase in cancellation of certificate of registration was consistent because of non-compliance with the strict entry point norm which requires maintenance of a minimum net owned funds of ₹2 crores. Moreover, certificate of registration has also cancelled due to exit of NBFCs from the business of deposit taking. However, since the Infrastructure Leasing and Financial Service (IL&FS) crisis in 2018, there has been continuous policy intervention by RBI to strictly monitor and regulate the business activity of NBFCs that accentuated the decline in their numbers (refer Table 1). As a contrast to the number of NBFCs, total asset size of NBFCs has continuously increased since 2005-2006 (refer Figure 2). The estimated CAGR of the total assets of the NBFCs since 2005-2006 is 18.76 per cent (refer Table 1).

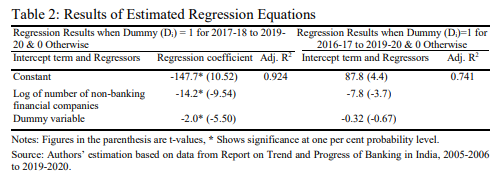

Considering 2016-2017 as the year of great divide, the computed compound annual growth rate of asset size of NBFCs for the period 2005-2006 to 2016-2017 and from 2017-2018 to 2019-2020 stood at 19.6 per cent and 14.5 per cent respectively (refer Table 1). Obviously, the rate of expansion of the asset size of NBFC sector slowed down in the second phase from 2017-2018 to 2019-2020. Two immediate factors that have emerged from analysis which have tended to slow down growth of asset size are steeper decline in number of NBFCs overtime and other is the stricter policy intervention by RBI, especially since 2017-2018. These observations require empirical support to hold true which has been provided by fitting a regression equation between the growth of asset size as dependent variable and number of NBFCs along with dummy variable for policy intervention since 2017-2018, for which Di=1 and 0 otherwise. The estimation of this regression equation has also enabled us to verify first two hypotheses: that of significant association between asset size, number of NBFCs and policy intervention. The estimated regression equation is given in Table 2:

From Table 2, it is evident that regression coefficients associated with the number of NBFCs and dummy variable (Di=1 since 2017-2018 and 0 otherwise) are negative and significant. One percent increase in number of non-banking financial companies is associated with a 14.2 per cent decrease in asset size of the non-banking financial companies. Moreover, the years of regulatory interventions, reduces the of asset size of non-banking financial companies in a greater proportion, keeping all other factors constant. Therefore, null hypothesis stands rejected and alternative hypothesis is accepted, regarding significant negative association between asset size and number of non-banking financial companies along with response of policy changes as is measured by dummy variable. More than 93 per cent of variations in the log values of asset size of NBFCs is explained by explanatory variables. This means that events unfolded since 2017-2018 have significantly affected asset size.

It is in place and necessary to mention another important finding from Table 2, that if we just shift the dummy variable to immediately preceding year (i.e., Di = 1 since 2016-2017), the regression coefficient associated has changed dramatically (refer Table 2) and has become insignificant. Though, one may argue that the period of last three years for which Di takes value 1 is short, it is pivotal in the sense that the moment we drag the dummy one year back, the dummy variable loses its significance which implies that we cannot ignore the policy change since 2017-2018, which has been instrumental in impacting the growth of asset size. This shows convincingly that there were some events since 2017-2018, that have turned those insignificant regression coefficients into significant ones. Those events include both the policy interventions introduced by Reserve Bank of India since 2014 and the crises crippling the NBFC sector, as well as the policy responses to those crises. In 2018, Infrastructure Leasing and Financial Service (IL&FS) defaulted on several of its debt obligations which led to rating downgrades and liquidity stress in the NBFC sector. As a policy response to which, RBI and government of India took a slew of measures such as introduction of Finance Bill 2019, which conferred powers on RBI to strengthen the governance of NBFCs, liquidity risk management framework etc. Externalities arising out of crisis along with the tightening of regulation on entire NBFC sector, led to a fall in the growth rate of asset size of NBFCs from 19.6 per cent in 2005-2006 to 2016- 2017 to 14.3 per cent in 2017-2018 to 2019-2020.

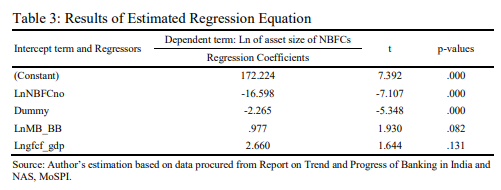

In addition to these two factors, there are other factors too that have bearing on growth of asset size of NBFCs which should be included in the regression model so that the behavior of these two variables (i.e., number of NBFCs and dummy variable representing stricter policy regulation) along with other plausible factors, could be comprehensively captured. In this context, an additional factor that influence asset size, is ratio of market borrowings to bank borrowings of NBFCs, because both of them are important sources of funds to NBFCs. And movement in their ratio would obviously exert its clout on asset size of NBFCs. Besides this, another important factor is investment rate of the economy, increase in which implies surge in aggregate demand for goods and services that requires financial institutions including NBFCs to cater the emerging financial needs of the economy. Both these additional variables are expected to cause positive impact on growth of asset size of NBFCs and whether their positive impact is strong enough to dilute the negative impact of other two variables (i.e., number of NBFCs and dummy variable representing stricter policy regulation). The inclusion of the two additional variables namely ratio of market to bank borrowings and investment rate of the economy, has also facilitated in verifying the third hypothesis regarding the significant positive impact of ratio of market to bank borrowings and investment rate on the asset size of NBFCs. Thus, in all, there are four plausible determinants of growth of asset size of NBFCs. The impact of all these four variables on the growth of asset size is highlighted in Table 3, which shows the results of fitted regression equation:

The value of adjusted R2 for the model stood at 0.935 whereas Durbin-Watson d statistic (d*) stands at 1.8 which falls within the range of dU < d* < 4-dU (Koutsoyiannis 2011) implying that the null hypothesis of no autocorrelation is accepted. Moreover, we also tested for multicollinearity using the Klein’s rule of thumb (Gujarati, et. al. 2012) and found absence of severe multicollinearity among the regressors. The value of R2 for the model, i.e., when asset size is regressed on rest of four explanatory variables, is 0.953 which is greater than the R2 obtained from the auxiliary regression which is obtained by regressing the independent variables namely investment rate, ratio of market borrowings to bank borrowings, number of non-banking financial companies and dummy variable, on each of three others, the value of R2 for which is 0.851, 0.480, 0.951 and 0.909 respectively. Clearly in each case the value of R2 is less than the overall R2. Hence, as the Klein’s rule of thumb states that the multicollinearity may be troublesome only if the R2 obtained from an auxiliary regression is greater than the overall R2, it is clear from the above that there is absence of severity of multicollinearity. Table 3 shows that the impact of number of NBFCs and dummy variable is negative and significant on the growth of asset size which is in consonance with the results displayed in Table 2. One percent rise in number of non-banking financial companies reduces the asset size by 16.5 per cent whereas the years of regulatory interventions on the non-banking financial companies sector depress their assets in a greater proportion. However, ratio of market borrowings to bank borrowings of the NBFC sector (LnMB_BB) and investment rate (Lngfcf_gdp) in the economy have positive but insignificant impact on the NBFC assets. Here, alternative hypothesis stands rejected while null hypothesis is accepted, regarding association of ratio of market borrowings to bank borrowings and investment rate in the economy, with the asset size of non-banking financial companies. Now, one needs to dig deeper into the insignificance of the coefficient associated with the ratio of market borrowings to the bank borrowings and investment rate (refer Table 3). The insignificant and positive association of ratio of market borrowings to the bank borrowings with the assets of NBFC sector implies that the change in ratio of market borrowings to bank borrowings couldn’t significantly prop up the asset size of NBFC sector. We have plotted the ratio of market borrowings to bank borrowings with respect to years under analysis (2006-2020) (refer Figure 3).

The movement of the curve (refer Figure 3) exhibit two important years of change when there was a steep fall in this ratio, one in 2009-2010 and other in 2017-2018. The initial point of change appears to be transitory in nature emerging from the global financial crisis 2008 which compelled NBFCs to streamline their market borrowings while the second year of change happens to be permanent in the sense that it has emerged because of certain regulations imposed by RBI which cannot be set aside unless regulations are repealed. But there is little possibility on any stepping by the Reserve Bank of India in regard to reallocation of prudential norms on selectively identified NBFCs as future course of action has already been put forth by RBI in the form of Scale Based Regulatory (SBR) Framework to be implemented with effect from October 1, 2022. This permanent shift occurring since 2017-2018 has caused the ratio of market borrowings to bank borrowings to exert insignificant impact which otherwise would have been significant. Our inference is also supported by the fact that the dummy variable continued to exercises negative and significant impact on the asset size of NBFC (refer Table 3). This dummy also points to the changes since 2017-2018 have adversely affected the NBFCs growth of asset size. It is interesting to notice that the second year in which ratio of market borrowings to bank borrowings has declined steeply is coinciding with the year of structural change that was diagnosed while analyzing the trend of growth of NBFC sector when the number of NBFCs has also declined and this decline is steep, which is also a consequence of tightened regulatory norms.

Lastly, investment rate defined in terms of ratio of gross fixed capital formation to gross domestic product at current price, has a positive but insignificant impact on the asset size of NBFCs (refer Table 3). The disconnect between investment rate and asset size of NBFCs implies that the NBFCs have their penetration in those segments which are not actively catered to by the mainstream investments due to highly risky nature of those segments. Risky nature of segments requires a specialized financial institution which can precisely optimize the risk and investment efficiency. Hence such financing is undertaken by the NBFCs sector which specializes in undertaking loans and demands of those segments. For instance, NBFCs target second-hand vehicle finance, promoter finance, buy now pay later, etc., which are lightly touched by the mainstream investments. Due to their active involvement in these segments, NBFCs develop an eye to see more in less, i.e., they can cater to the customer efficiently on individual basis and optimize the risk associated with them. Moreover, NBFCs are the chief innovators in the financial system as they play a vital role in innovating the financial instruments which can be later adopted by the banks in the long run. Loans against gold and housing finance in India are prime examples of such innovations which were later embraced by banks. Recently, buy now pay later (BNPL) mode of credit disbursement is being pioneered by the NBFCs and is widely accepted by mainstream banking system.

In the light of major determinants of growth of non-banking financial companies in India, it is quite evident that regulatory interventions are a major factor. Recently with the advent of scale-based regulatory framework and prompt corrective action framework for non-banking financial companies, Reserve Bank of India has clarified its objective of tightly regulating the non-banking financial company sector and imposing bank-like regulations on some of them. Regulatory interventions are done with the aim of curbing the risks emanating from the non- banking financial sector. However, are detrimental in the growth path of the NBFCs as is clear from the above analysis. Therefore, it is important to understand the extent of coverage of regulations on the non-banking financial companies. It is in place to mention that the risk-taking is a unique selling proposition (USP) of NBFCs in which they specialize as they target specific segments and understand deeply the credit-worthiness of the loanee. Curbing the risk by putting uniform regulations on the NBFCs will be the beginning of restraining the growth opportunities of NBFCs and hence the sector in which they finance actively. It is very important to analyze the risk versus investment efficiency before imposition of enhanced prudential norms and large companies whose risk has exceeded the investment efficiency are the ones which are systemically important for the economy and hence their business must be cut-down to the extent that risk posed by them is less than or equal to their investment efficiency. Only such companies must be tagged as systemically important and made subject to enhanced prudential norms. The devil lies in details of usage of term systemically important with respect to NBFCs in India.

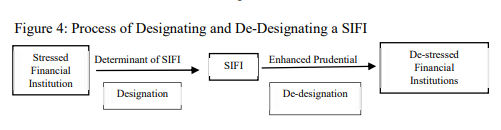

Currently, NBFCs are classified on the basis of their asset/liabilities structure, systemic importance and type of activities. In terms of systemic importance, non- deposit taking NBFCs are classified into systemically important non-deposit taking NBFCs (NBFC-ND-SI) and other non-deposit taking NBFCs (other NBFC- ND). Non-deposit taking NBFCs having an asset size greater than ₹500 crore are classified as NBFC-ND-SI, threshold of which has now proposed to be revised to ₹1000 crore, in recently published scale-based regulations with effect from 01 October 2022. The methodology of assigning the tag of systemically important is the Achilles heel for the entire NBFC structure. The definition of systemically important NBFCs is in wide divergence with the way it is defined elsewhere in the world. For instance, in United States of America, Financial Stability Oversight Council (FSOC) lays down six determinants to identify the systemically important financial institutions (SIFIs) which were size, interconnectedness, substitutability, leverage, liquidity risk and maturity mismatch. And based on these indicators, FSOC defined SIFI as “if material distress at US NBFC, could threaten the financial stability then that particular entity must be designated as systemically important financial institutions. And once a financial institution is tagged as SIFI, it is made subject to enhanced prudential norms such as risk management rules, liquidity norms, capital requirements etc. These enhanced prudential norms have a penalizing implication for the designated SIFI and it is made sure that the institution must scale-down its operations or business to the extent that it is no more posing a threat to the financial stability which implies that there is a proper set mechanism to rescind the designation of SIFI (refer Figure 4).

In sharp contrast to this, India has neither any mechanism of designation of systemically important nor is there any procedure in place to rescind the tag of systemically important as the tag is not given with the spirit of penalizing the financial institution. Rather, the term systemically important is used merely as a basis of distinction based on the asset size without any calculation of the perceived riskiness of NBFCs having an asset more than ₹500 crore which is now being revised to ₹1000 crore in recently published scale based regulations. That is, it has been implicitly assumed by RBI that all the non-deposit taking NBFCs which once cross the asset size limit of ₹500 crore will start posing systemic risk and hence are classified as systemically important. Moreover, NBFCs having an asset size as low as ₹500 crore and NBFCs having an asset size as high as ₹1,00,000 crore are all identified as systemically important which is far away from any logical explanation. Once the NBFCs cross the asset size threshold of ₹500 crore, they are designated as systemically important and are made subject to prudential norms. Due to the ill-defined structure of NBFC sector on the basis of their systemic importance, the policy interventions by RBI are also affecting the innocuous NBFCs. It is in place to mention that there is strict need for RBI to use the term systemically important in the same spirit as is done elsewhere and impose enhanced prudential norms only on those handfuls of designated systemically important ones which should have penalizing implications with the objective of rescindment of the tag of systemically important. Moreover, it is also necessary to calibrate the regulations on the lightly regulated NBFC sector but it should be done with extreme caution, keeping in mind that the growth of the NBFC sector remains unscathed.

Therefore, it can be conclusively observed that if there is any exogenous shock in the form of new prudential norms, say scale-based regulatory framework, then it may inhibit the asset growth of NBFCs and there is hardly anything to wonder that it may lead to significant positive association between the growth rate of asset size and declining growth of number of NBFCs which would be a matter of deep concern especially for those areas where NBFCs have active involvement in terms of financing such as financing of second-hand vehicles. In an effort to protect the sector through a heap of prudential norms, the regulatory measures may become a hammer of collapse for the entire NBFC sector leading to the simultaneous setting off the bigger NBFCs or their exit from the sector leading to a shrink in the growth of asset size of an NBFC.

II Conclusion and Policy Recommendation

Non-banking financial companies have shown a stupendous growth miracle in the past few years and have successfully taken care of largely un- catered segments of the Indian economy. This is evident from the fact that though the number of non- banking financial companies have registered a decline at a compound annual growth rate of 2.1 per cent, their asset size has grown at an annual compound growth rate of 18.76 per cent. This emphatic growth of asset size, despite the declining number of NBFCs, is fading away since 2017-2018. A severe crisis in the form of default of Infrastructure Leasing and Financial Services (IL&FS) on its debt obligations has hit the sector hard in 2018. Along with it, policy responses since 2014, which were further intensified after the Infrastructure Leasing and Financial Services crisis, have further slowed down the growth of asset size. These observations are evident by the decline in the compound annual growth rate of asset size of NBFC for the period 2005-2006 to 2016-2017 and 2017-2018 to 2019-2020, which stood at approximately 19.6 per cent and 14.3 per cent respectively. An intricate analysis regarding the determinants of growth of asset size of NBFCs for the period 2005-2006 to 2019-2020 has revealed interesting findings. It has been observed in our analysis that the declining growth of a number of NBFCs has a significant negative impact on the growth of assets of NBFCs coupled with the significant negative impact of dummy variable taking the value 1 since 2017-2018 and 0 otherwise. Although the period for which dummy takes the value 1 seems small, it withholds its importance due to the fact that shifting the dummy to incorporate one preceding year, makes it insignificant, which implies that the major policy interventions and economic events in the period of 2017-2018 to 2019-2020 has a significant negative impact on asset growth of non- banking financial companies. This corroborates with our observation that the tightening of regulatory norms on the non-banking financial sector have tended to slow down the pace of growth of assets of NBFCs. Moreover, ratio of market borrowings to bank borrowings has an insignificant positive impact on the growth of assets of NBFCs. Our thorough probe regarding the rationale of insignificant impact of ratio of market borrowings to bank borrowings has revealed that policy intervention by RBI to reduce dependence on market borrowings has led to a fall in the ratio of market borrowings to bank borrowings. With respect to investment rate in the economy, it has been observed that it has insignificant positive impact on the growth of assets of NBFC sector which is due to the fact that NBFC’s application of fund is mostly concentrated in those segments that are lightly touched by the mainstream investments due to highly risky nature of such segments such as financing of second-hand vehicle, buy now pay later, promoter financing etc. NBFCs actively participate in these segments due to their specialization in taking and managing efficiently, the risks associated with these sectors. In this light, it becomes imperative to look at the incidence and effects of prudential norms imposed on the NBFC sector to contain the contagion of systemic risk. Prudential norms are mostly concentrated on non-deposit taking systemically important which contributes almost 86 per cent of total asset size of NBFC sector. Recommending blanket prudential norms for handling the spread of systemic risks, on all non-deposit taking systemically important is counter- productive for the growth of entire sector. Instead, a risk-based approach is a wiser way to contain the contagious systemic risks in the Indian financial system. It is required to adopt a targeted, nuanced and risk-based approach, to not only foresee any financial contingency emanating from non-deposit taking systemically important NBFCs but also facilitate the continuation of growth miracle of the NBFC sector. This can be done only by revisiting the definition of systemically important in India which is in wide divergence with the global usage. In India, there are no procedures in place for designation of systemically important financial institutions, imposition on enhanced prudential norms on them and finally the process of de-designation. At the preliminary stage, there is need to correctly identify companies through a defined procedure, and then impose enhanced prudential norms on such companies. Therefore, correct diagnosis is required for effective policy response and there is a need to correctly identify the companies which may pose substantial systemic risk to the financial system. Effective policy response implies that regulations should be optimized in such a way that growth is not hampered in view of protecting the NBFCs and that can be done only by re- structuring the NBFC sector by identifying systemically important NBFCs. Narrative on growth of non-banking financial companies will differ once the structure of NBFCs will be re-defined just by nudging.

References

Acharaya, V., H. Khandwala and T.S. Oncu (2013), The Growth of a Shadow Banking System in Emerging Markets: Evidence from India, Journal of International Money and Finance, 39(December 2013): 207-230, https://ideas.repec.org/a/eee/jimfin/v39y2013icp207-230.html,

Accessed on: 16-07-2022.

Apostoaie, C.M. and I. Bilan (2020), Macro Determinants of Shadow Banking in Central and Eastern European countries, Economic Research– Ekonomska Istrazivanja, 33(1): 1146-1171, https://doi.org/10.1080/1331677X.2019.1633943 Accessed on: 10-01-2022.

Awasthi, A. and S. Shukla (2022), Need to Redefine Systemically Important Non-Banking Financial Company in India, Vinimaya, 42(3): 49-55.

Bhaskar, P.V. (2014, January 23), Non-Banking Finance Companies: Game Changers. Address at National Summit on Non-Banking Finance Companies- Game Changers, Retrieved from https://m.rbi.org.in//scripts/BS_SpeechesView.aspx?Id=870, Viewed on 22/01/2022.

Gelzinis, G. (2019), Strengthening the Regulation and Oversight of Shadow Banks, Center for American Progress, https://www.americanprogress.org/issues/economy/reports/2019/07/18/ 471564/strengthening-regulation-oversight-shadow-banks/, Accessed on- 07-11-2021.

Greene, E.F. and E.L. Broomfield (2013), Promoting Risk Mitigation, Not Migration: A Comparative Analysis of Shadow Banking Reforms by the FSB, USA and EU, Capital Markets Law Journal, 8(1): 6-53, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=

2206448, Accessed on: 13-01-2022.

Gujarati, D.N., D.C. Porter and S. Gunasekar (2012), Basic Econometrics, McGraw Hill Education, New York.

Koutsoyiannis, A. (2011), Theory of Econometrics, Palgrave, New York.

Ministry of Statistics and Programme Implementation (MoSPI), National Account Statistics (NAS), Back-series of National Account (base 2011-12) and Annual and Quarterly Estimates of GDP, May 2021, https://www.mospi.gov.in/web/mospi/reports-publications/-/reports/view/ templateOne/6405?q=RPCAT and https://www.mospi.gov.in/web/mospi/download-tables- data/-/reports/view/templateOne/16701?q=TBDCAT, Accessed on: 15-01-2022.

Oncu, T.S. (2013), Are Indian NBFCs Shadow Banks? Do They Pose Systemic Risks? Economic and Political Weekly, 48(51): 10-11, https://www.epw.in/journal/2013/51/h-t-parekh-finance- column-columns/are-indian-nbfcs-shadow-banks-do-they-pose, Accessed on: 16-07-2022.

Ordonez, G. (2018), Sustainable Shadow Banking, American Economic Journal: Macroeconomics, 10(1): 33-56, https://www.jstor.org/stable/10.2307/26528422, Accessed on: 15-01-2022.

Reserve Bank of India (2005-06 – 2019-20), Report on Trend and Progress of Banking in India, Mumbai, https://www.rbi.org.in/Scripts/AnnualPublications.aspx?head=Trend per cent20and per cent20Progress per cent20of per cent20Banking per cent20in per cent20India, Accessed on: 10-01-2022.

———- (2021), Scale Based Regulations (SBR): A Revised Regulatory Framework for NBFCs, Reserve Bank of India, Mumbai, https://rbidocs.rbi.org.in/rdocs/notification/PDFs/ NT1127AD09AD866884557BD4DEEA150ACC91A.PDF, Accessed on: 22-01-2022.